I have had interest in the concept of Micro-finance since my encounter with Kuya from Kenyatta University. Kuya was a very interesting lecturer for a unit called Economics of Micro-finance. I remember vividly how Kuya went on and on about the concept of group lending that later spread all over the world. In brief, Mohammad Yunas started the concept in Bangladesh and encouraged people from poor backgrounds to get small loans at affordable rates of interests to improve the livelihood of poor people. This later led to formation of the first micro-credit bank called Grammen Bank. For his work in advancing this model, he won a Nobel Peace Prize in 2006. Through the concept of micro-credit, entrepreneurs from poor background were able to get access to affordable finance that they would otherwise not have been able to get access to in traditional banking system model.

Fast forward to today, this model has been advanced to form what is the basis of modern day chamas and sacco movement. Kenya is ranked the best country in Africa in terms of number of saccos, growth, management and impact of Saccos to the common people and 7th globally. With an estimated 15,000 registered saccos in Kenya, majority of people especially in the rural areas have been able to uplift their living standards and alleviate poverty. Indeed, i believe that if we entrench the Sacco basics to the young population in Kenya, we are able to cultivate a good savings culture for people at a young age. Kenya cannot achieve its Vision 2013 without reducing the sprawling levels of youth unemployment that we are witnessing today. Given that not all people can get access to funding, ensuring that young people in the informal sector save through a well established sacco system can have a more positive impact. In rural areas, Chamas have been transforming the livelihoods of many people because they are present in virtually all sectors. People contribute as low as ksh 50 or even ksh 100 daily and within a short period of time, they undertake investments that they would otherwise not have been able to undertake. More resources in terms of member education on financial literacy could be very vital for these chamas that have grown to eventually become registered saccos.

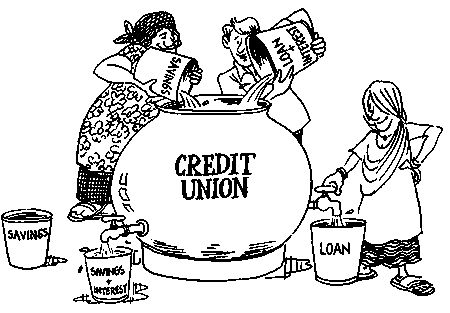

One of the basic principles of a sacco is that one must save in order to get access to credit. Majority of the Saccos offer up to 3 times the amount of savings. Therefore consistent savings of up to Ksh 50,000 can give you a loan of about ksh 150,000. I consider the model of savings and investing through Sacco a good model because firstly it gives you that saving culture. Imagine If someone decides to save ksh 150,000 for a project. This might take a long time. If you save ksh 5,000 every month, you can be eligible for skh 150,000 loan after just 10 months or less. However, for you to save up to ksh 150,000 it would take 30 months (If you save Ksh 5000 every month). Considering the time value of money, you can save for 10 months and get a loan to finance your small scale project. By the time you get to 30 months, your project could be on its way to success. in addition, saccos offer lower rates of interest on loans compared to banks. Majority of the Saccos offer as low as 12% interets p.a mainly on reducing balance basis. Compare that the current bank rate of over 19%.

The case of Ubunifu Sacco (‘Ubunifu Sacco’ on Facebook) can be used as an example of the potential that lies with youth based Sacco. Ubunifu Sacco morphed from a savings club to become registered as a Sacco in April 2015. The start up Sacco (which i am part of) was formed with the purpose of mobilizing savings from young entrepreneurs who would otherwise not get credit from banking institutions. Within a short period of time, we have been able to grow membership to 41 members currently with cumulative monthly deposits of about 1.8 million. An amount of close to ksh 1.1 million has already been disbursed as loans since the Sacco started lending in November 2015. Currently, around ksh 500,000 is advanced as loans every month to members. Members contribute only ksh 4,000 every month. (about ksh 130 daily). The Sacco has achieved the above within a few months of being in operation, imagine what will happen a year from now if the consistency is maintained. The potential is definitely there (PS. Join Ubunifu Sacco Today, Check out the Facebook Page for details). I believe there are other youth based saccos out there. They present a good opportunity for pooling funds that can be channeled to viable investment opportunities. Members who a year ago could not access loans from banking institutions despite having incomes, though irregular, have now the ability to borrow money to pay for school fees, fund their businesses and support their families. Members act as guarantors to each another thereby eliminating the need for elusive collateral in terms of fixed assets. There is untapped potential here and Saccos can help entrench the savings culture while turning around the living conditions of young people.

The most important aspect that can propel growth and success of youth-led Saccos is training for board and employees in terms of financial stewardship and corporate governance. This can enable the Saccos to generate enough wealth to cover operational costs. With support from institutions such as Ministry of Industrialization, SASRA, District Cooperative officers and other agencies such as Co-op Consultancy and Insurance Agency (CCIA), these Saccos can and overcome the initial start up barriers. The entrepreneurial spirit can be nurtured early enough while at the same time enabling young entrepreneurs to learn important money lessons while still in their early years of growth.

Innovativeness in Sacco products is one area that youth based Saccos need to fully exploit in order to become more relevant to young people. Services such as access to credit through mobile money services is one of them. Linking these money transfer services to back-office financial databases can lower operational costs because saccos will require fewer staff while increasing efficiency. In addition, with right framework, Saccos can offer products such as funding of innovative start ups from members. Switching to virtual platforms that eliminate the need for brick and mortar establishments would also be a viable avenue for growth. Integrating technology innovation and new products can be expensive for start up Saccos and therefore partnerships with ICT companies and other institutions could prove very strategic. Its time more young people became involved in their our future rather than laying back and wait for ‘the big break’ while we can use what we have to build a more promising future. we can use the little income we get from side hustles and do bigger things. We just have to imagine big, pool funds and start small.

Leave a comment